Uncertainty ahead for agri-food sector while consumers benefit from lower inflation

There is significant uncertainty ahead for Northern Ireland’s agri-food sector, but consumers are benefiting from lower food price inflation, according to the Ulster Bank.

The message was outlined at a key event in the build up to their sponsorship of the 2019 Balmoral Show.

Ulster Bank Senior Agriculture Manager Cormac McKervey, and the bank’s Chief Economist NI Richard Ramsey, updated members of the Guild of Agricultural Journalists as well as other stakeholders, on the performance of the local farming and food sectors and related economic issues.

They were joined by Ulster Bank Head of Northern Ireland Richard Donnan, who affirmed the bank’s commitment to supporting the farming and food sectors as they continue to play a key role in the Northern Ireland economy, .

Speaking at the bank’s annual briefing in the Ulster Bank Entrepreneur Accelerator in Belfast, Mr Donnan said: “The agri-food sector is a crucial component of the Northern Ireland economy and we are strongly committed to continuing to support it through the funds we have available to lend and the expertise of our team. That includes support for farmers and primary producers right through the supply chain, including some of our biggest and best-known food processors.

“Many potential challenges in relation to how Brexit might unfold remain and how agricultural policy is shaped locally and in Westminster going forward is also crucial. However, our local agri-food companies have proven themselves to be adept at focusing on the things they can control so that they are well positioned to capitalise on whatever opportunities also emerge. That means continuing to generate great authentic produce and products, increasing value-add, and through investing in R&D and innovation to improve productivity and distinctiveness.”

Cormac McKervey, Senior Agriculture Manager at Ulster Bank said: “Farming in Northern Ireland has enjoyed a relatively positive past 18 months, with the strong recovery in the dairy sector having a big effect on overall performance. The atmosphere in the sector also remains generally optimistic, despite some clear uncertainty related to Brexit. To highlight this, rural land prices rose by 4.4 percent in the past year, and figures released by UK Finance indicate that deposits have increased over the last year. This may be partly explained by farmers holding off on planned capex until Brexit outcomes become clearer.

“Aside from Brexit, one of the major challenges in Northern Ireland is high ammonia levels, due to farming here being so intensive. In turn this could impact on expansion plans and some farmers may need to invest in measures to help reduce ammonia emissions,” Mr McKervey adds.

Richard Ramsey, Chief Economist NI at Ulster Bank also pointed out that 2018 was a less positive year for farming in Northern Ireland than the year before.

He said: “We need to understand the context, which is that 2017 was a record year for farm income, with an increase of 82 percent in real terms compared to 2016. All-in-all, it has therefore been a positive past 24 months for the agri sector.

“The fall in TIFF (Total Income from Farming) last year was driven by high costs of feedstuff. Gross output from farming in Northern Ireland was up one percent, according to the figures, with all sectors recording growth except for the pig sector, the potato industry, and the horticulture sector. Interestingly, egg production saw a record high in 2018, with 149 million eggs produced in Northern Ireland; a rise of 7.2 percent on the year before.

“Looking ahead, there is no shortage of potential challenges for the agri-food sector and for food and drink manufacturers in particular. In addition to the obvious concern around potential tariffs and regulation changes, any impact on supply chains and the supply of labour would create considerable problems. The agri-food sector tends to be volatile at the best of times, being sensitive to exchange rate fluctuations and other factors such as the weather. However, in addition to the cyclical changes that the sector is all-too-well used to, the rules of the game itself appear to be changing, but to what, we don’t yet know.”

Mr Ramsey added that the environment for the agri-food sector is an uncertain one, but he said that consumers are at least seeing inflation easing, and food prices actually falling, according to the latest data.

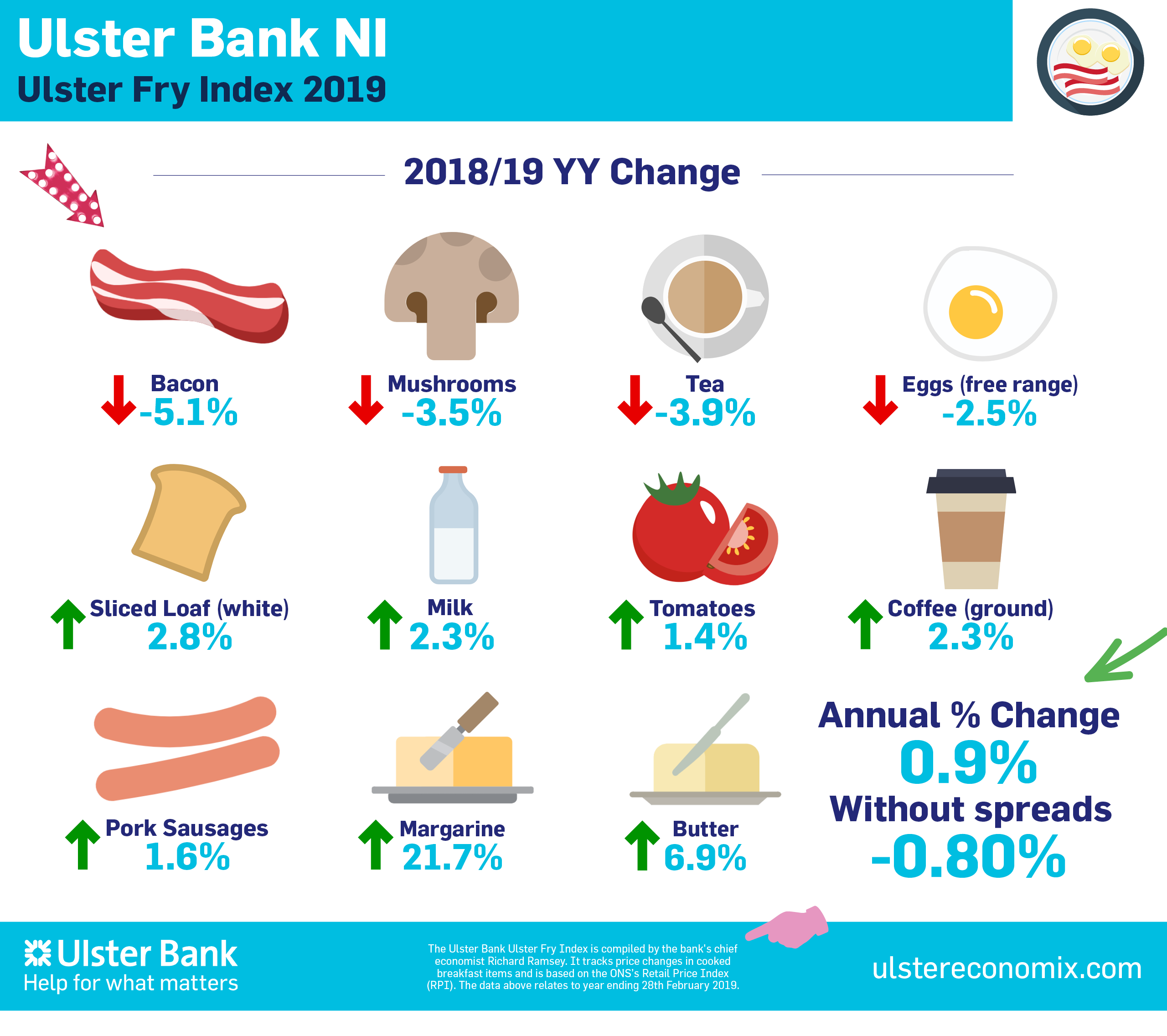

To illustrate the point, he presented his annual Ulster Bank Ulster Fry Index, which shows that the price of a number of items making up a cooked breakfast actually fell in the year to the end of February, using the UK Retail Price Index (RPI).

Bacon was the biggest faller, with a price drop of 5.1 percent in the 12-months. The price of tea fell by 3.9 percent, and the cost of eggs was down 2.5 percent.

Bacon was the biggest faller, with a price drop of 5.1 percent in the 12-months. The price of tea fell by 3.9 percent, and the cost of eggs was down 2.5 percent.

A number of other items rose at rates well below the headline inflation rate, including sausages (1.6 percent), and tomatoes (1.4 percent).

Overall, the Ulster Bank Ulster Fry Index – the average inflation rate of the items included – rose at a very modest 0.9 percent in the past year, its lowest rate of inflation since 2016. The annual rate of inflation for the Ulster Fry Index was 2.8 percent in March 2017 and 4.3 percent in March 2018.

Margarine (a whopping 21.7 percent) and butter (6.9 percent) saw the biggest rises in the last year. Taking them out of the equation though leads to an annual fall in the overall Ulster Fry Index of 0.8 percent.

The price change in the various items in a traditional breakfast are contained within the accompanying infographic.

Looking at changes over time, despite the rise in the past 12 months, the Ulster Fry Index is still 8.1 percent lower than it was five years ago. Though it is 25 percent higher than 10 years ago. Since the EU-Referendum in June 2016, the Ulster Fry Index has increased by 6.8 percent.

Richard Ramsey says that the Ulster Fry Index is a bit of fun but contains an important economic message: “Food makes up a significant proportion of household spending. ‘Food and drink’ is also a key sector of the Northern Ireland economy. So, understanding how the price of food items is changing gives us some insight into both the current state of consumer finances, and also some of the challenges facing the agri-food industry,” Mr Ramsey says.

“There are a wide range of alternative indices around the world – from the Big Mac Index to the Cappuccino Index – which are intended to explain economic terms in a straightforward way and to shed new light on important economic issues. Ours is the Ulster Fry Index, and it hopefully gives the man or woman on the street a clearer idea of why their household finances currently are the way they are.”