Back-to-school boost drive sales in Northern Ireland

Grocery inflation now stands at 5.9% for September, marking the 12th consecutive month of falling inflation, reaching a level last seen in October 2022, new figures suggest.

The average annual grocery bill is set to rise by £330, from £5600 to £5930, if consumers don’t change their shopping habits, the latest figures from Kanter show.

And as retailers continue to place emphasis on promotions to attract shoppers through the door, over 22.4% of sales were made through promotional offers – the highest level so far this year.

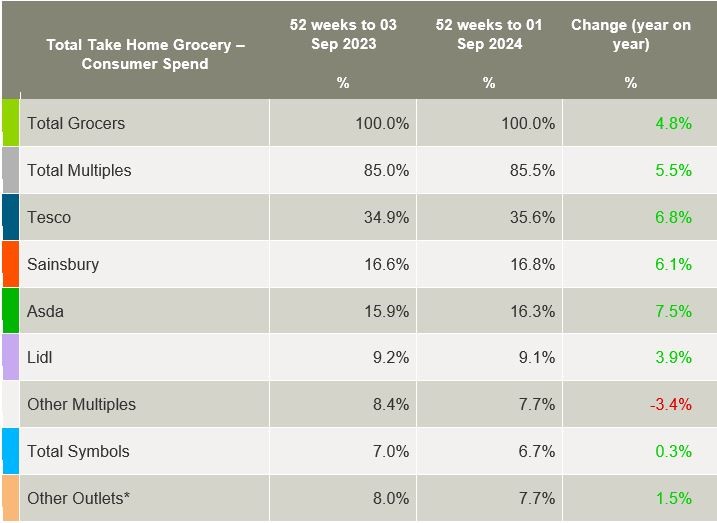

In the year to 1st September 2024, £4.25 billion passed through the tills, up 4.8% year-on-year, an additional £194.5m compared to last year. Take-home grocery sales grew as shoppers marginally increased their volume per trip, contributing a combined £21.6m to overall performance.

Emer Healy, Business Development Director at Kantar said there were still positives to take away.

“Brands are also regaining market share this period, growing by 0.7 percentage points year-on-year, and now holding 54.6% of the value market share, with an additional £135m in shopper spending year-on-year,” said Emer.

“Own-label products remain important within retailer ranges, growing in value by 3.8% year-on-year, although lagging behind the overall market, which is up by 4.8%.

“Despite the ongoing pressures on consumers, the latest 12 weeks saw people getting into the party spirit to celebrate the summer of sport. Cider grew in popularity, increasing by 4.6%, while accompaniments, including savoury snacks, were up by £3.3m. Despite the unpredictable summer weather, it certainly didn’t dampen the barbecues, with chilled burgers and grills growing by 12.1% in value sales, and fresh sausages increasing by 6.3%.”

Meanwhile, Tesco maintains its position at the top of the table as Northern Ireland’s largest grocer, with a 35.6% share of the market, up 6.8%. An increase in store visits contributed an additional £91.3m to its overall performance.

Lidl holds a 9.1% market share, up 3.9% year-on-year. The number of trips to stores remain steady from last month at 30.1 trips.

Sainsbury’s holds a 16.8% market share, up 6.1% and welcomed more shoppers in-store, contributing an additional £71.2m to its overall performance. Asda maintains its 16.3% share of the market, up 7.5% this period, and continued to welcome new shoppers in-store, along with larger trips, which contributed a combined additional £54m overall.