Average grocery bills could rise by £275 in the year

Spending on annual grocery bills could jump by £275 as the price of food continues to rise.

New figures have revealed that grocery price inflation accelerated again, sitting at 5.2%, hitting the highest level since January 2024, while take-home sales at the grocers grew by 5.4% in the four weeks to 13th July, according to Worldpanel (formerly Kantar).

With just under two thirds of households concerned about the cost of their food shop, their fears may well be realised with the prediction by Worldpanel that this latest rise could add almost £300 to their annual food bill if shopping habits remain the same.

Head of retail and consumer insight at Worldpanel, Fraser McKevitt said that people are adapting their habits in an attempt to avoid the full impact of price rises.

“Own label products, which are often cheaper, continue to be some of the big winners and in fact, sales of these ranges are again outpacing brands, growing by 5.6% versus 4.9%,” said Fraser.

“These inflationary worries aren’t just changing what we buy, but how we prepare it too. We often see people choosing to make simpler meals when they are trying to save money and today, almost seven in 10 dinner plates include fewer than six components.”

With budgets under pressure, supermarkets have been finding new ways to pique the interest of consumers, with innovation absolutely vital to help grocers keep up with new trends and make sure they’re meeting shoppers’ needs as behaviours and priorities shift.

“The drinks aisle in particular seems to be offering up plenty of inspiration,” added Fraser.

“Iced coffee has soared in popularity in recent years and with summer temperatures rising, sales were up this month by 81%. No and low alcohol drinks continue their gradual march into the mainstream too, with nearly seven in every 100 households buying a product this month, pushing sales up by 21%.”

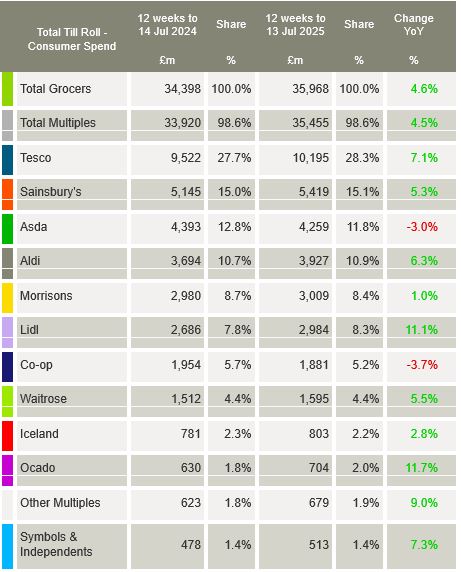

Meanwhile, Lidl reached a record high market share this period at 8.3%, gaining 0.5 percentage points as it attracted more than half a million new customers to its stores.

Tesco also boosted its share to 28.3% as sales grew by 7.1%, the fastest rate since December 2023, while sales at Sainsbury’s increased by 5.3%, putting its market share at 15.1%. Convenience specialist, Co-op takes 5.2% of the market, and frozen expert Iceland holds 2.2% of grocery spending.