Marginal drop in grocery price inflation

Grocery price inflation has come down slightly this month, now at 5.0%, down from 5.2% in July.

The latest figures from Worldpanel by Numerator show that take-home sales at the grocers grew by 4.0% over the four weeks to 10th August, versus last year.

Additionally, the sales of branded goods are growing ahead of own-label alternatives, showing the largest gap in favour of brands since March 2024.

While people are making savings outside of the home, they continue to seek treats in stores. Sales of branded grocery items grew by 6.1% this month, putting the ahead of own-label alternatives which were up by 4.1%.

Branded sales make up 46.4% of all grocery spending but are particularly dominant in personal care, confectionery, hot drinks and soft drinks, where they account for more than 75% of money through the tills.

While a far smaller part of the market, premium own-label also continues to do well, with sales rising by 11.5% in this period.

Head of retail and consumer insight at Worldpanel, Fraser McKevitt highlighted some interesting take aways from the latest figures.

“We’ve seen a marginal drop in grocery price inflation this month, but we’re still well past the point at which price rises really start to bite and consumers are continuing to adapt their behaviour to make ends meet,” he said.

“What people pay for their supermarket shopping often impacts their spending across other parts of the high street too, including their eating and drinking habits out of the home.

“Casual and fast service restaurants especially have seen a decline in visitors over the summer, with trips falling by 6% during the three months to mid-July 2025, compared with last year. The outliers in this are coffee shops, which have bucked the trend.”

Fraser also noted a significant milestone in freezer aisles this year, as the fish finger turns 70 in September.

“The humble fish finger remains as popular as ever and nearly one billion were sold in the past year, with more than half of households grabbing a box,” he said.

“The average home cook now spends three minutes less preparing the evening meal than they did in 2017 at just under 31 minutes. We can see this trend in the growth of things like microwaveable rice, ready meals and chilled pizza too, which have grown by 8%, 6% and 5% respectively.”

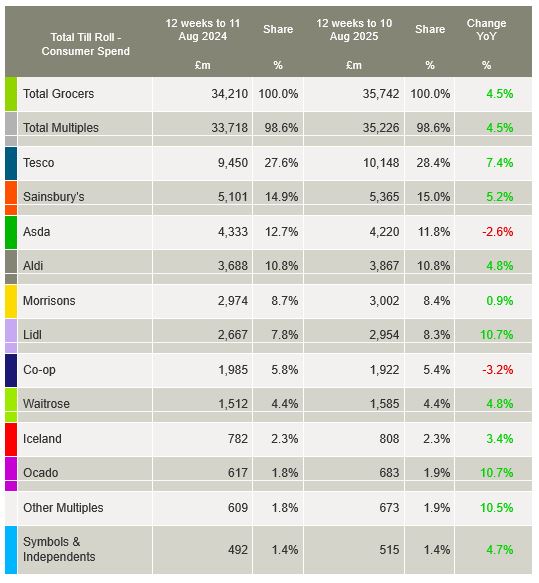

Meanwhile, amongst the supermarkets Tesco enjoyed its largest monthly share gain since December 2024, as its hold of the market rose by 0.8 percentage points to 28.4%. This was driven by sales growth of 7.4% compared to last year.

Spending through the tills at Sainsbury’s was up 5.2% on last year, taking its portion of the market to 15.0%. Lidl was one of the fastest growing grocers, (tied for top spot with Ocado), over the 12 weeks to 10th August 2025, with sales up by 10.7% compared to the same period last year. Lidl’s share of the market increased by 0.5 percentage points to 8.3%.

With its sales rising by 3.4%, Iceland’s hold of the market remains at 2.3%, while convenience specialist Co-op has a 5.4% share of take-home sales.