£4.43bn Christmas spend fuels Northern Ireland grocery growth

Take-home grocery sales rose by 2.2% in Northern Ireland in the year to 28th December 2025, latest figures show.

While people visited stores less often than in 2024, they bought more each time, adding an extra £71 million to the market. Meanwhile, sales reached a record £4.44 billion in December as shoppers treated themselves over the festive period.

New data from Worldpanel by Numerator also shows that grocery inflation now stands at 6.2%, up from 4.82% last month.

Shoppers celebrated in style this Christmas, with Monday 22nd December proving the busiest day in stores as households stocked up for the big day. In the run-up to Christmas, an extra £30.4 million was spent on alcohol, pastries, chocolate, savoury snacks and soft drinks.

Business Development Director at Worldpanel by Numerator, Emer Healy said promotions played a bigger role than ever.

“Shoppers in Northern Ireland saw a boost in typical Christmas fare and a combined £6.7 million was spent on Champagne, turkey, Brussels sprouts and parsnips as many tucked into a traditional Christmas dinner,” said Emer.

“Branded goods continued to perform well, with spending up £72.3 million, a 3% year-on-year increase, lifting their value share to 55% as shoppers turned to brands they know and trust. Own-label ranges also grew, up 0.9%, with an extra £16 million spent, taking their share to 42.7% of the market by value.

“Promotions played a bigger role than ever, with discounted items now accounting for 25.6% of value sales, a new record in Northern Ireland. In total, shoppers spent over £1.1 billion on promotions.”

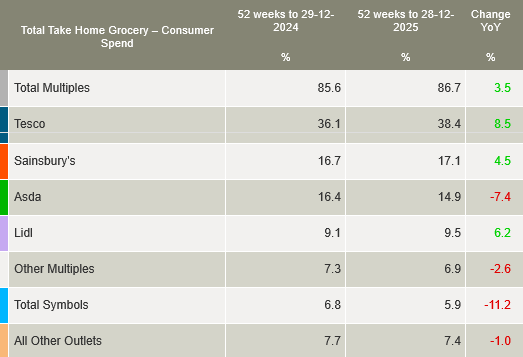

Meanwhile, Tesco remains Northern Ireland’s largest grocer, growing its market share to 38.4%, its highest level on record, up 8.5% on last year. This growth came from both new shoppers and bigger baskets, adding £104 million to its performance.

Sainsbury’s follows with a 17.1% share, up 4.5% year-on-year, boosted by new shopper recruitment worth £26.2 million.

Asda holds a 14.9% value share this period, while Lidl increased its share to 9.5%, up 6.2%. Lidl welcomed new shoppers and saw existing customers buying more per trip, contributing an uplift of £15.6 million.