Bread and cereals prices play part in pushing down inflation rate

Lower food prices helped push the inflation rate down in January, after an increase in December, latest figures reveal.

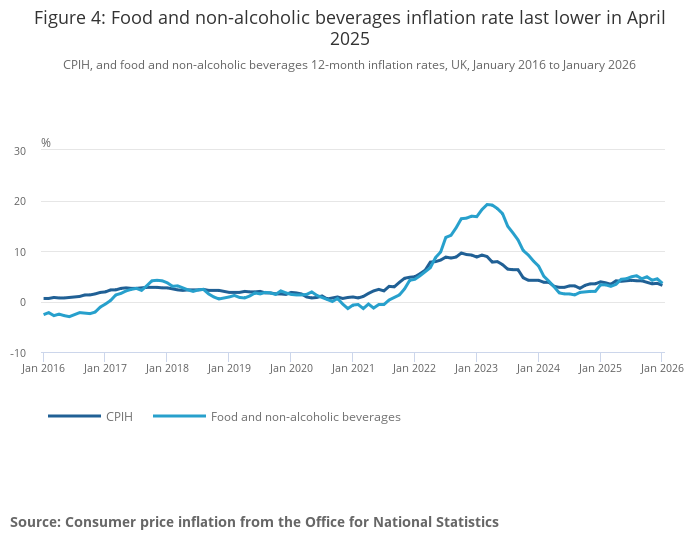

The inflation rate rose by 3.0% in the 12 months to January this year, down from 3.4% in December, with the latest statistics from the ONS showing that transport, and food and non-alcoholic beverages made the largest downward contributions to the monthly change in both CPIH and CPI annual rates.

The largest downward effect came from motor fuels, where the average price of petrol fell by 3.1 pence per litre between December 2025 and January 2026, compared with a rise of 0.8 pence per litre 12 months previously.

Similarly, diesel prices fell by 3.2 pence per litre in January 2026, compared with a rise of 1.5 pence per litre in January 2025. These movements resulted in overall motor fuel prices falling by 2.2% in the 12 months to January 2026, compared with rise of 0.9% in the 12 months to December 2025.

Meanwhile, food and non-alcoholic beverages prices rose by 3.6% in the year to January, down from 4.5% in the 12 months to December 2025. On a monthly basis, food and non-alcoholic beverages prices fell by 0.1% in January 2026, compared with a rise of 0.9% a year ago.

Bread and cereals had the largest downward effect, down 0.04 percentage points, with meat down 0.02 percentage points. Milk, cheese and eggs; coffee, tea and coca; and mineral waters, soft drinks and juices were all down 0.01 percentage points.

ONS Chief Economist, Grant Fitzner said inflation had fallen markedly in January to its lowest annual rate since March last year.

“Airfares were another downward driver this month with prices dropping back following the increase in December,” he said.

“Lower food prices also helped push the rate down, particularly for bread and cereals and meat. These were partially offset by the cost of hotel stays and takeaways.

“The cost of raw materials for businesses fell over the past year, driven by lower crude oil prices, while the increase in the cost of goods leaving factories slowed.”

James Walton, Chief Economist at IGD said that the 0.9% drop in food and drink inflation would offer some relief to households.

“The 0.9% drop was larger than IGD expected and played a major role in reducing overall inflation to 3.0%,” he said.

“Food prices are set to stay volatile, however. Commodity markets remain unpredictable, business costs continue to rise, and recent severe weather adds further uncertainty. These create planning challenges for suppliers and retailers alike.

“Resilient supply chains are key to a long-term solution. Progress is underway, but until deeper structural reform is delivered, the risks of renewed inflation will stay elevated. In short: food inflation has eased but volatility will define much of 2026.”