Long-awaited sunshine and summer of sport brings spending boost for NI

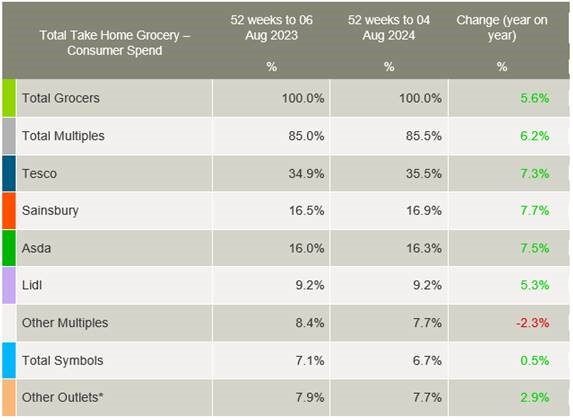

There was a summer boost for grocery spending in Northern Ireland, with a 5.6% increase year-on-year, according to the latest figures.

In the year up to 4th August, £4.25 billion ran through the tills, an additional £223.6 million compared to last year.

The latest Northern Irish grocery market share figures from Kantar revealed that take-home grocery sales grew as shoppers visited stores more frequently, alongside slight increases in volume per trip, contributing a combined £20.9 million to overall performance.

Thanks to a month filled with sport and some long-awaited sunshine, Northern Ireland shoppers spent an additional £7.4 million on beer and lager, £3.4 million on crisps, £3.5 million on mineral water and £2.9 million on ice cream.

Now standing at 6.65% for August, this marks the 11th consecutive month of grocery inflation decline to levels last seen in October 2022.

“Although inflation levels are falling, they remain high, and consumers in Northern Ireland are still facing significant pressures on their household budgets, making the landscape as competitive as ever,” said Emer Healy, Business Development Director at Kantar.

‘Consumers in Northern Ireland are still facing significant pressures on their household budgets’

“Retailers continue to emphasise own-label lines and promotions to attract shoppers through the door. Own-label products are growing just behind the total market at 5.1% year-on-year, with shoppers spending an additional £89.6 million on these ranges compared to last year. Brands grew slightly ahead of the market, at 6.5% year-on-year and hold a 54.5% share of the market by value. Over 22% of sales were made through a promotional offer, a level not seen since October 2020,” added Emer.

Meanwhile, Tesco maintains its position at the top of the table and is Northern Ireland’s largest grocer with a 35.5% share of the market up 7.3%. Tesco welcomed more frequent trips which contributed an additional £101.5 million to their overall performance.

Lidl holds 9.2% market share, up 5.3% year-on-year. An increase in store visits contributed an additional £3.9 million to Lidl’s overall performance.

Sainsbury’s holds a 16.9% market share, up 7.7%, with more frequent trips contributing an additional £101.4 million to their overall performance. Asda holds 16.3% of the market up 7.5% this period and welcomed new shoppers in store alongside larger trips which contributed an additional £49.6 million overall.