Back-to-school spending lifts Northern Ireland grocery sales by £76 million

The return to routine, school and work for countless Northern Ireland households all played a part in a 2% increase in grocery spending compared to 2024.

In the year to 7th September 2025, £4.4 billion was spent in Northern Ireland’s grocery sector, representing a 2% increase on the previous year.

The latest data from Worldpanel by Numerator reveals that this growth was partly driven by the end of the summer holidays and the return to school and work for many families. Although shoppers made 2.8% fewer trips to stores, they bought more items per visit, adding £76.1 million to overall market growth. Grocery inflation now stands at 3.38%, up slightly from 3.09% last month.

With routines returning after the summer, an extra £57.5 million was spent on wine, fruit, chocolate and toiletries. Households with children also boosted their spending on typical lunchbox staples, with an additional £11.4 million going on soft drinks, water, biscuits, smoothies and yoghurts.

Emer Healy, Business Development Director at Worldpanel by Numerator said that while there is still a demand for branded goods, own-label goods continue to be in demand by consumers.

“Branded goods remain popular, with spending up £41 million, a 1.7% increase year-on-year, which lifted their value share to 54.9%. Own label also performed strongly, growing by 2.2% as shoppers spent an extra £40.6 million, taking its share to 43.2% of the market by value,” said Emer.

Emer added that to make the most of their budgets, many consumers are choosing a mix of own-label items and promotions.

“Promotions continue to play a key role in the market, accounting for 23% of value sales, the highest level recorded to date in Northern Ireland, with over £1 billion spent on discounted products,” she said.

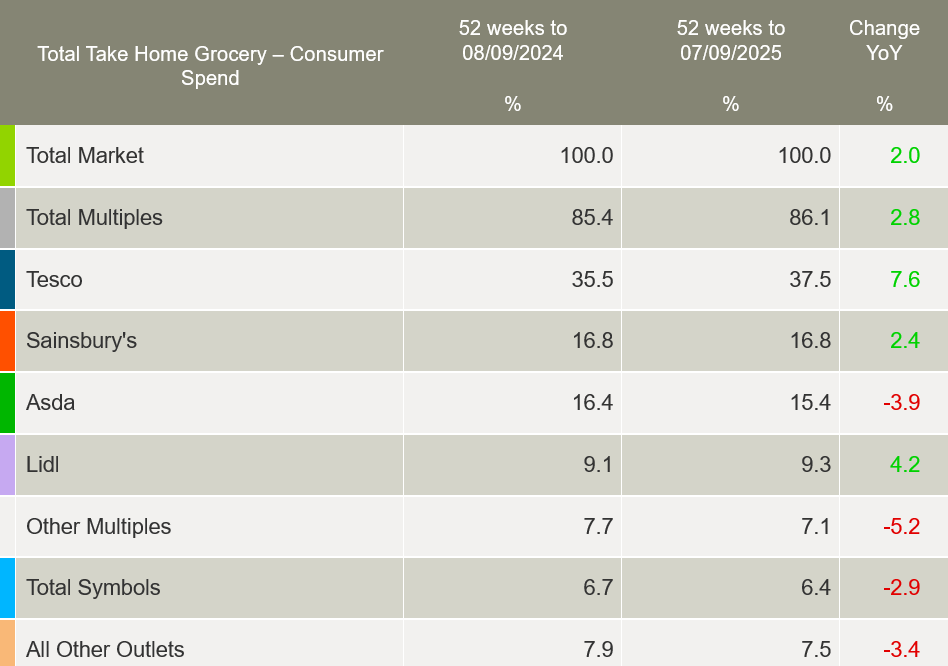

Meanwhile, in the supermarkets, Tesco retains the largest market share at 37.5%, up 7.6% from last year. This growth was driven by both new customer acquisition alongside larger trips, contributing £83.3 million to its overall performance.

Sainsbury’s holds a 16.8% market share, up 2.4% year-on-year. A rise in shopper numbers and basket size helped boost its performance by £21.3 million.

Asda holds 15.4% value share this period and welcomed new shoppers in store which contributed £5.5 million to their overall performance. Lidl’s market share rose to 9.3%, an increase of 4.2%, as the retailer attracted new customers in store alongside existing shoppers making more frequent trips. This resulted in an uplift of £12.8 million.