Consumer confidence picked up slightly but remained low in the final quarter of 2022

Consumer confidence in Northern Ireland increased modestly in the fourth quarter of 2022 but remained low as the impact of higher prices on household finances continued to weigh on sentiment.

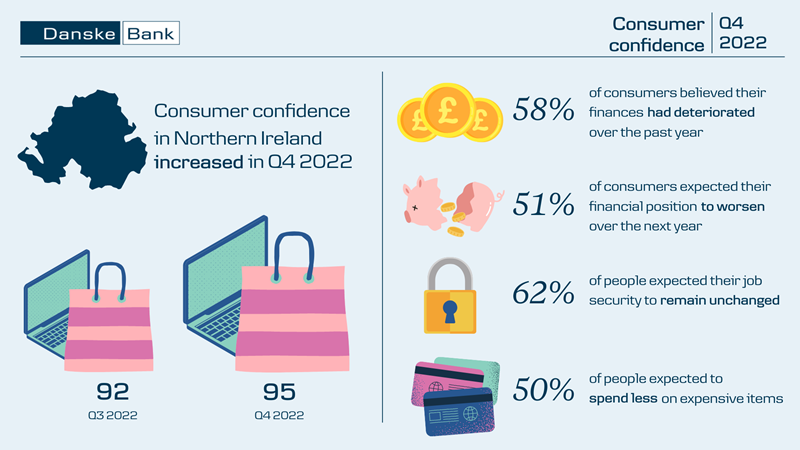

Danske Bank’s latest consumer confidence index rose slightly to 95 in the last three months of 2022, up from 92 in the previous three months. Carried out in December last year, it is still below the reading of 134 posted in the fourth quarter of 2021.

A total of 1018 people were surveyed with information on household savings also gathered.

Thirty-six per cent of respondents said that the adjustment of society to living with Covid-19 had the largest positive impact on sentiment, while 15% said the overall performance of the local economy had the biggest positive impact on confidence.

overall performance of the local economy had the biggest positive impact on confidence.

When comparing their current financial position with the previous year, 14% of people felt their financial position had improved over the 12 months, however 58% felt their finances had deteriorated.

For many people (40%) the impact of higher prices on household finances was having the largest negative impact on them, with 14% stating rising interest rates had the largest negative impact on sentiment.

‘One of the main factors behind this low level of consumer sentiment is the high rate of inflation, which is squeezing household purchasing power’

The part of the index which examines the amount consumers expect to spend on high-value items, such as furniture and holidays, over the next 12 months increased over the quarter, but decreased over the year; 17% of consumers expected to spend more on expensive items compared with 50% who expected to spend less.

Inflation is expected to decline during 2023 but it will likely take some time for it to return to the 2% target. As such, and when combined with relatively low

confidence levels, consumer spending is projected to remain under pressure.

Danske Bank’s Chief Economist and Head of Strategy, Conor Lambe said that inflation remains at “elevated levels” and is continuing to “exert a squeeze” on household spending power.

“While it was encouraging to see a small rise in consumer confidence in the final quarter of 2022, it should be noted that overall confidence levels remain relatively low,” he said.

“One of the main factors behind this low level of consumer sentiment is the high rate of inflation, which is squeezing household purchasing power.

“As we move through 2023, inflation is expected to continue declining, but it will likely take some time for it to return to the 2% target.