Food prices main driver for fall in inflation

Falls in food and clothing and footwear helped drive inflation down in February, easing to its lowest rate in almost two and a half years.

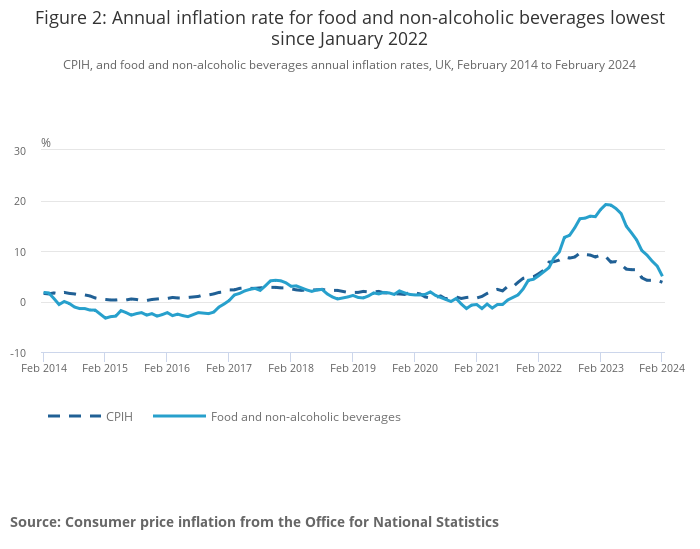

The latest figures from the Office for National Statistics (ONS) show that prices for food and non-alcoholic beverages rose by 5.0% in the year to February 2024, down from 7.0% in January.

The rate has eased for the 11th consecutive month from a recent high of 19.2% in March 2023, the highest annual rate seen for over 45 years.

The annual rates for most types of food product eased between January and February 2024, with the largest effect coming from bread and cereals. Overall, prices for bread and cereals rose by 0.3% on the month, compared with a rise of 2.3% between January and February 2023.

Prices of packs of cakes and some bread products (eg. white sliced loaves) fell between January and February this year but rose a year ago.

The ONS reports that other smaller downward effects came from classes such as meat, vegetables, and milk, cheese and eggs.

Overall, the annual rate eased in 10 of the 11 food and non-alcoholic beverages classes with oils and fats the exception; its annual rate rising from 8.0% in January to 8.3% in February 2024.

ONS Chief Economist Grant Fitzner said: “Food prices were the main driver of the fall, with prices almost unchanged this year compared with a large rise last year, while restaurant and café price rises also slowed.

“These falls were only partially offset by price rises at the pump and a further increase in rental costs.”

Meanwhile, Kris Hamer, Director of Insight at the British Retail Consortium (BRC) said the latest inflation figures were good news for consumers, but warned government not to be complacent.

“Significant costs on the horizon may put renewed pressure on overall inflation in the near future; these include a 6.7% rise in business rates, and reforms to the packaging levy and electrical takeback schemes, all in the context of the biggest rise to NLW on record,” he said.

“This will limit investment and drive up costs at a time when many families are still facing a higher cost of living.”