Health, heat and higher prices shape spending on groceries

Own-label products are one to watch as inflation creeps back to 3-4% analysts have stated.

Take-home grocery sales grew by 4.4% over the four weeks to 18th May compared with last year, while in the same period, grocery price inflation also saw a marked rise to 4.1% – its highest level since February 2024.

Prices rose fasts in markets such as chocolate confectionery, suncare and butters & spreads, while the fastest falls came in dog food, cat food and household paper products.

With the hottest start to May on record, barbecue favourites and sun cream were amongst the top purchases for consumers, who also continue to shop with health in mind, with sales of sports nutrition products and fresh fruit surging since the start of the year.

The latest figures from Kantar show that consumers continue to shape their diets around lifestyle choices, but getting the best value is forefront of their considerations.

“The growth of spending on deals has carried on this month, increasing by 5.1% versus May last year,” said Fraser McKevitt, head of retail and consumer insight at Kantar.

“Trimming prices remains the most popular way for retailers to draw in customers, with 80% of promotional spending this period down to straightforward price cuts.”

Amidst the rises, there were reasons to be cheerful with shoppers enjoying the hottest ever start to the month.

“We’ve been firing up the barbecues a bit earlier than last year, with chilled burgers flying off the shelves and sales growing by 27%,” added Fraser.

Shoppers didn’t forget the all-important sides, as sales of potato salad rocketed by 32% and coleslaw and prepared salads by 19% each. As the mercury rose, sun cream sales also shot up by 36% as Brits made the most of the spring sun.

With the mid-year point approaching, Kantar has been investigating what’s been trending in supermarket baskets, with Fraser stating consumers have health, well-being and exercise seemingly top of many people’s minds.

“Sports nutrition products have been the biggest winners,” he said.

“The number of these products bought has surged by 45% over the past five months versus the same time in 2024. Volume sales of cottage cheese, flatbreads and fresh prepared fruit have all be growing strongly too, up by 30%, 29% and 22% in each case.”

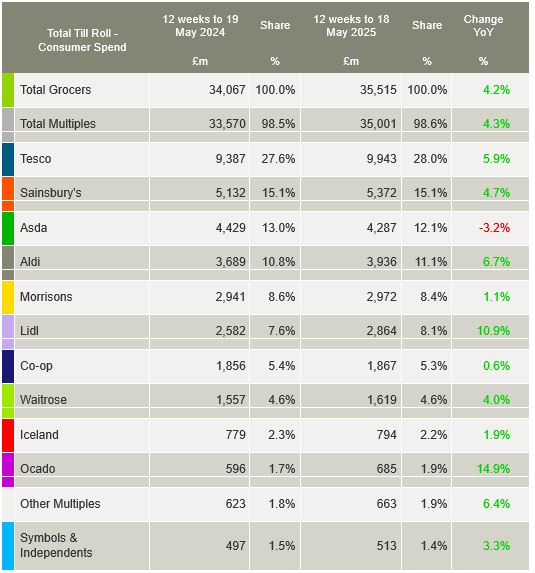

Meanwhile, it was a strong period for discounters, which achieved their strongest combined growth since January last year at 8.4%. Lidl reached a new share high of 8.1% with sales up by 10.9%.

Compared with the same period last year, it brought 419,000 extra shoppers through its doors, the most of any retailer.

Tesco boosted sales by 5.9% to increase its share by 0.4 percentage points and now has 28.0% of the market, while sales growth at Sainsbury’s accelerated by 4.7%, giving it a 15.1% share, and Asda saw its best performance since May last year, with its share now standing at 12.1%.

Despite enduring the repercussions of the cyber attack, spending on groceries at M&S rose by 12.3%, while sales at Co-op increased by 0.6% to take 5.3% of the market.