NI retail sector enjoyed growth in January states latest report

There was growth in the Northern Ireland retail sector last month, despite inflation rates remaining elevated.

Indeed, it was reported that retail was “the star performer” in January with an increase in sales and employment in the sector rising at its fastest pace since May 2018.

According to the latest report by Ulster Bank, there were “signs of improvement” with the retail sector enjoying employment growth.

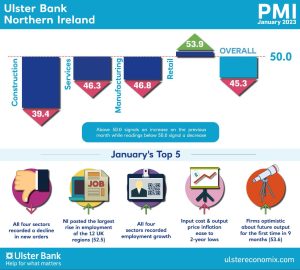

The January data from the Ulster Bank NI PMI, produced for the bank by S&P Global, showed that while the private sector remained in “contraction territory” at the beginning of this year, there were “signs of the downturn losing pace”.

‘REBOUND IN RETAIL’

The monthly survey of 200 businesses in the retail, construction, manufacturing and services sectors, revealed that all four sectors recorded an increase in staffing levels in January.

Chief Economist Richard Ramsey said the rebound in retail sales and sentiment was “perhaps surprising” as Northern Ireland remains in the midst a cost-of-living crisis, but said there were two main factors driving it.

“Unlike Northern Ireland and the UK, the Republic of Ireland is neither in nor flirting with recession and cross-border shopping is providing some valuable support,” he said.

“During the second half of January, the £600 energy grant also started arriving with households, and in some instances, this subsidy seems, in part at least, to have found its way into the tills of local retailers.”

It appears that the “extreme pessimism” reported last year “appears to have lifted” said Mr Ramsey, with only construction firms expecting further falls in output in 12 months’ time. Meanwhile, manufacturing and retail are their “most optimistic” in 10 and 11 months respectively.

EMPLOYMENT GROWTH

“Employment growth accelerated to a six-month high with all four sectors increasing staffing levels in January. Indeed, NI firms posted the fastest rise in employment levels of all 12 UK regions. This was despite the fact local firms posted the sharpest decline in output within the UK in January,” he said.

“This suggests that local firms are hoarding labour, given the difficulty in recruiting staff and widespread skills shortages. How sustainable this approach is will be tested in the months ahead.”

Some of the main findings of the January survey showed the headline seasonally adjusted Business Activity Index remained below the 50.0 no-change mark in January, but rose to 45.3 from 41.6 in December, to signal a softer reduction in output at the start of 2023. However, activity has now fallen in nine successive months, with the latest decline linked to the challenging demand and inflationary environment.

“With output and new orders falling at softer rates, firms expressed renewed optimism in the year-ahead outlook for business activity, the first instance of positive sentiment since April last year,” added Mr Ramsey.