NI shoppers seek value while spending heated up for Valentine’s Day

A total of £4.3 billion passed through tills in Northern Ireland in the year up to 23rd February, representing an increase of 1.2% compared to last year.

While the latest figures show that shoppers made fewer trips to stores (-0.7%), they picked up more packs per trip than last year, contributing an additional £19.3 million to the overall market performance.

The latest report from Kantar shows that grocery inflation in Northern Ireland now stands at 2.26%, down from 2.5% last month.

Northern Irish shoppers spent an additional £37.7 million on their favourite brands – an increase of 1.6% year-on-year – boosting branded value share to 54.8%. Own label grew at a slower rate of 0.9%, with shoppers spending an additional £17 million compared to last year. Own label holds a 43.3% value market share, down slightly by 0.1 percentage points year-on-year.

Business Development Director at Kantar, Emer Healy said that many shoppers in Northern Ireland had turned to promotions alongside own-label products in a bid to find the best value in the market.

“Promotional activity remains strong, accounting for over 22.5% of value sales, with shoppers spending almost £1 billion on promotional deals,” said Emer.

“Love was in the air as many shoppers celebrated Valentine’s Day at home, spending an additional £9 million on ready meals, frozen confectionery and wine.”

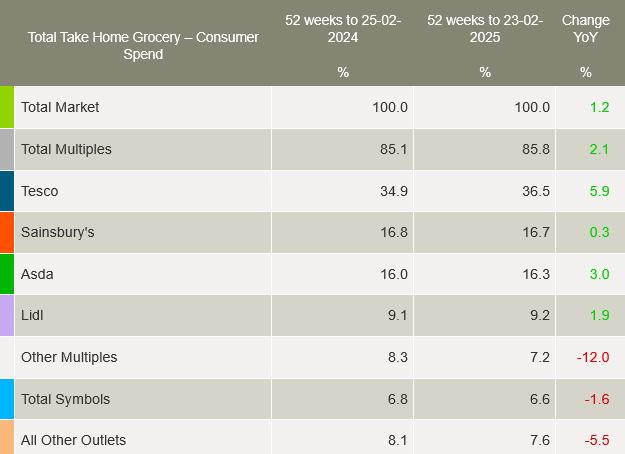

Meanwhile, Tesco continues to lead in market share performance, holding 36.5% of the market – up 5.9% compared to last year. This growth is driven by an increase in the number of trips to stores alongside attracting new shoppers, contributing an additional £69.3 million to its performance.

Sainsbury’s holds a 16.7% market share, with sales up 0.3% year-on-year. The retailer welcomed an influx of new shoppers while existing shoppers picked up more volume, which contributed £48.2 million to its overall performance.

Asda holds 16.3% of the market, up 3% over this period, with increases in volume per trip and new shoppers contributing a combined additional £17.3 million to its performance. Lidl holds a 9.2% market share, up 1.9% year-on-year, with more frequent trips boosting overall performance by £5.9 million.