Northern Irish consumers seek cheaper alternatives to cope with the high cost-of-living

As Northern Irish shoppers look for ways to manage costs, many are turning to cheaper alternatives, such as retailer own label lines, new research has shown.

According to the latest research by Kantar, sales of retailers’ own-brand products are up by £56.1m compared to branded products, which are up by £44.5m.

As food and drink prices continue to climb, with average prices up 9% compared to last year, the impact on shoppers’ budgets is unavoidable for many NI consumers, with shoppers now spending on average £175.34 more per buyer year-on-year.

SEASONAL BOOST

Mother’s Day and St Patrick’s Day gave a small (1%) boost to alcohol sales, with shoppers spending an additional €896,000 year-on-year. Cider saw the strongest growth of 44.8% compared with last year, as shoppers spent €1m more.

With Easter approaching, consumers have been stocking up on festive essentials, with chocolate sales up 35% year-on-year (£2.1m) and sales of large Easter eggs up 45% compared to last year.

‘Grocery inflation now stands at 12.8% for March, which means the average annual grocery bill is set to rise to £633’

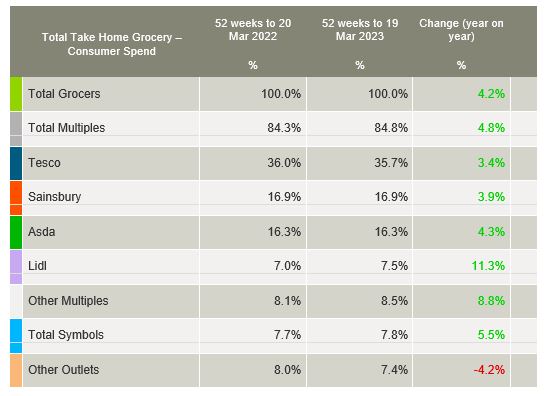

Emer Healy, Senior Retail Analyst at Kantar said: “The Northern Irish grocery market saw sales grown by 4.2% in the year to 19th March 2023, with shoppers spending an additional £149.9m year-on-year.

“Grocery inflation now stands at 12.8% for March, which means the average annual grocery bill is set to rise by £633, from £4950 to £5583, if consumers don’t make changes to their shopping habits.”

MARKET SHARE

In Northern Ireland, Tesco maintains its position at the top of the table and is Northern Ireland’s largest grocer, with a 35.7% share of the market. The retailer welcomed an influx of new shoppers in store alongside more frequent trips, which contributed an additional £78.5m to their overall performance.

Lidl holds a 7.5% market share, seeing the strongest growth amongst all retailers, up 11.3% year-on-year, thanks to an influx of new shoppers alongside more frequent trips which contributed £27.1m to their overall performance.

Sainsbury’s holds 16.9% share and saw a boost of new shoppers which contributed an additional £31.2m to their overall performance, while Asda holds 16.3% of the market this period and welcomed new shoppers in store alongside existing shoppers purchasing more often, which contributed an additional £20.1m overall.