Promotions, premium own-label and no alcohol options – consumers’ main Christmas shopping choices revealed

Take-home grocery sales reached a record £13.8 billion last month, as shoppers got into the Christmas spirit, up 3.8% year-on-year.

Grocery inflation eased slightly to 4.3%, offering modest relief to shoppers, who on average spent £476 at the supermarkets in December – an additional £15 in comparison to December 2024.

The latest data from Worldpanel by Numerator reveals that spending on promotions and deals reached its highest levels since before the pandemic at 33.3%, while supermarket premium own-label sales exceeded £1 billion for the first time.

As anticipated, Monday 22nd December was the busiest day for grocery sales, however shoppers made the most trips on Tuesday 23rd December, spending less but topping up on last-minute festive essentials.

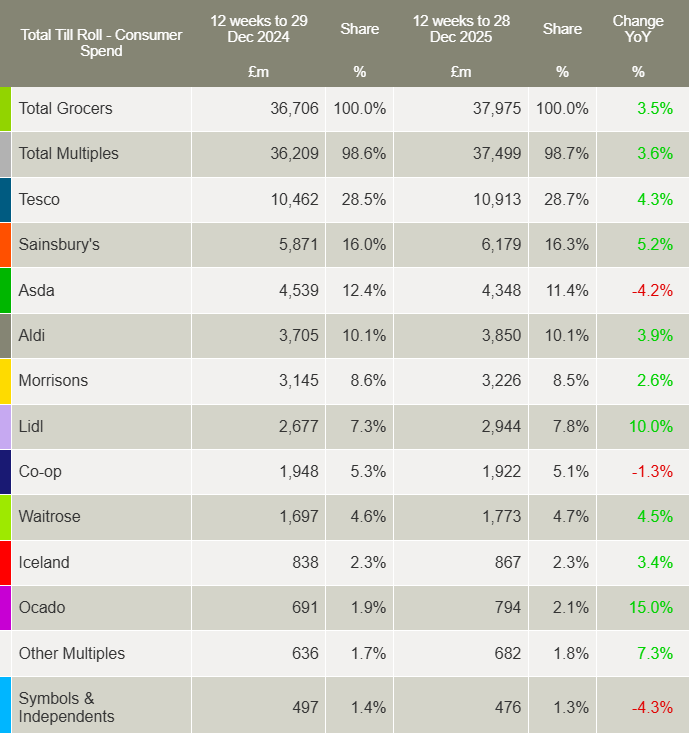

While traditional, large format supermarkets accounted for 60.3% of sales over the four-week period to 28th December, discounter retailers saw their biggest ever share of sales at Christmas, reaching a total of 16.8%. Online retail grew also at 7.5%, reaching a total share of 12.2%.

Notably, chocolate remained one of the top purchases for consumers, despite higher prices, with chocolate’s exposure to inflationary cocoa process bring the typical price of seasonal tubs to over £5 for the first time. And despite average pack sizes shrinking by 5% down to 551g, these festive favourites remained a tradition with sales rising by 19% in the four weeks to Christmas, with nearly one million shoppers buying into the category.

Fraser McKevitt, Head of Retail and Consumer Insight at Worldpanel by Numerator said easing inflation gave households a little more room to spend.

“It was a Christmas of smart savings and considered choices – almost every household bought into supermarkets’ premium ranges, while price remained front of mind,” he said.

“Over the last five years, the number of households cutting alcohol out of their shopping basket altogether has steadily increased. Alongside this, we’ve seen a rapid rise in sales of low and no-alcohol alternatives. However, the slight dip in the numbers of buyers in December may signal that the category is beginning to mature, while the rise in sales shows that converted households are doubling down on their favourite low and no-alcohol tipples.

“What’s clear is that as consumers, we’re open to more variance during those traditional, festive moments – whether it’s switching the Bucks Fizz for Kombucha or enjoying a classic cocktail alongside a more health-focused option, consumers are finding enjoyment in more choice.”

Meanwhile, Tesco sales were higher than in 2024, with its share rising by 0.2 percentage points to 28.7%, the greatest proportion of the market since March 2015. Lidl made the greatest gain in market share among the supermarkets, adding 0.5 percentage points to claim 7.8% of the market – a record for the discounter over the festive period.