Sports-filled month boosts savouries and beer sales in Northern Ireland

Grocery inflation now stands at 7.5% for July – the 10th consecutive month of decline and now sitting at a level last seen in November 2022, according to the latest figures.

This means the average annual grocery bill is set to rise by £420 from £5600 to £6020, if consumers don’t change their shopping habits, marketing analysts, Kantar reports.

A month filled with sports led to Northern Ireland shoppers spending an additional £3.3 million on take-home savouries and £4 million on beer and lager compared to last year. Colder than average days in July led to an 8.8% increase in sales of cold treatments and shoppers spending €351k more on soup versus to last year, whereas sales of sun preparations fell by 13.8%.

Although inflation levels are falling, they are still high and consumers in Northern Ireland are still facing significant pressures on their household budgets, making the landscape as competitive as ever. Own-label remains popular as shoppers tighten their purse strings, growing ahead of the total market at 6.8% year-on-year, with shoppers spending an additional £119 million on these ranges compared to last year. Also, over 22% of sales were made through a promotional offer, a level not seen since October 2020.

‘Take-home grocery sales grew, with shoppers visiting stores more often’

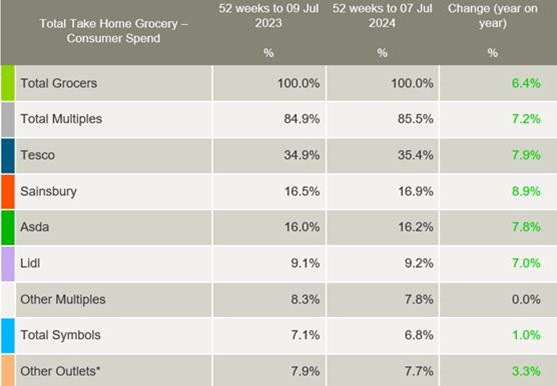

Emer Healy, Business Development Director at Kantar said: “In the year to 7th July 2024, £4.25 billion ran through the tills, up 6.4%, which is an additional £256.7 million compared to last year.

“Take-home grocery sales grew, with shoppers visiting stores more often, on average over one more trip than last year, though the number of packs they picked up grew only marginally by 0.4%.”

Meanwhile, Tesco maintains its position at the top of the table and is Northern Ireland’s largest grocer, with a 35.4% share of the market, up 7.2%. Tesco welcomed more frequent trips, which contributed an additional £85.3 million to their overall performance.

Lidl holds a 9.2% market share, up 7% year-on-year. The discounter welcomed new shoppers in store, contributing an additional £3 million to their overall performance.

Sainsbury’s holds a 16.9% share, up 8.9%, and welcomed more frequent trips, contributing an additional £128 million to their overall performance, while Asda holds 16.2% of the market, up 7.8% this period, and also saw a boost in new shoppers and larger trips, contributing an additional £37.5 million overall.