Consumer confidence falls once again

Consumer confidence continued to fall in Northern Ireland as rising inflation and higher prices put pressure on household finances.

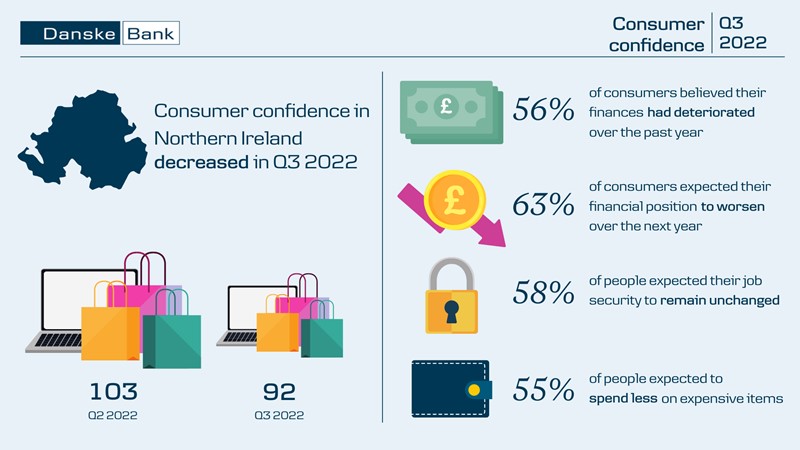

As high prices continue to squeeze household budgets, the Danske Bank NI Consumer Confidence Index fell significantly to 92 in 2022 Q3, down from 103 in the second quarter of the year.

This is also significantly lower than the 137 posted in the third quarter of 2021. The survey was carried out in September of this year.

Consumer confidence is an economic indicator measuring the degree of optimism consumers have regarding the overall state of Northern Ireland’s economy and their own financial situations.

Compared with Q2, people reported feeling less confident about their current finances, future finances, job security and expected spending on expensive items.

High inflation is exerting a significant squeeze on purchasing power and with confidence at low levels, the outlook for consumer spending is particularly challenging.

Forty-seven per cent of survey respondents said they felt that the impact of higher prices on their household finances had the largest negative impact on them, while 13% said global risks, including the war in Ukraine, was the main factor that made them feel less confident.

For 11% of people, the post-Brexit trading arrangement in NI had the largest negative impact on them.

‘Inflation in the UK is at a multi-decade high and is exerting a significant squeeze on consumer spending power’

Conor Lambe, Chief Economist and Strategy Lead, Danske Bank

Comparing their current financial position to last year, over half (56%) of respondents believed their finances had deteriorated, while 18% felt their financial position had improved.

Indeed, looking ahead to the next 12 months, 63% of people thought their finances would worsen, with 15% expecting their financial position to improve.

Looking at a regional breakdown, confidence levels fell in Q3 in all four regions (Belfast City, North, South and West), although Danske Bank stressed that the regional indices are based on smaller samples than the overall NI measure.

In Belfast City, confidence levels fell from 119 in 2022 Q2 to 101 in the third quarter and were also significantly weaker than the 148 posting in 2021 Q3.

In the North region, consumer confidence declined from 107 to 97; in the South region the index reading was 84, down from 94 and in the West region the index reading of 92 was lower than the 98 recorded in 2022 Q2.

Conor Lambe, Chief Economist and Strategy Lead at Danske Bank said this was the fifth consecutive quarterly decline in sentiment.

“Inflation in the UK is at a multi-decade high and is exerting a significant squeeze on consumer spending power,” he said.

“This high inflation is the factor having the largest negative impact on confidence levels. Beneath the headline figures, price pressures are evident across a wide range of goods and services.

“Household energy continues to experience significant annual price increase. Food inflation has been rising with the annual change in prices increasing from 14.8 per cent in September to 16.5 per cent in October.”

However, he said that there were some factors that had a positive impact on confidence in Q3.

“Thirty-five per cent of people said the adjustment of society to Covid-19 positively impacted them, a significant change compared with the Q3 survey from two years ago in 2020 when coronavirus restrictions was one of the largest negative drivers of sentiment.

“Fourteen per cent said the performance of the local economy made them feel better and nine per cent pointed to rising wages as a factor boosting confidence,” he added.