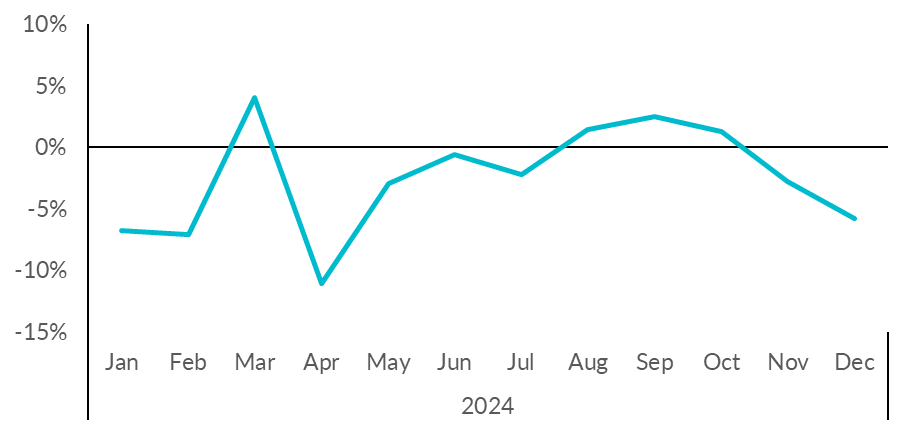

Poor footfall figures for December round off disappointing 2024

Despite it being the traditional ‘Golden Quarter’, footfall in Northern Ireland decreased by 3.0% (year-on-year) for the three months to December, according to the latest figures.

Northern Ireland footfall decreased by 5.8% in December (year-on-year), down from -2.8% in November, the Northern Ireland Retail Consortium-Sensormatic data showed. This is the largest decrease of the four nations and lower than the UK average decrease of 2.2%.

Shopping Centre footfall decreased by 5.7% in December (yoy) in Northern Ireland, up from -7.3% in November, while footfall in Belfast in December decreased by 7.2% (yoy), down from -2.3% in November.

Neil Johnston, Director of NIRC said it was important to note that the later timing of Black Friday in 2024 meant it fell into December figures, rather than November, while the reverse is true in 2023. This would artificially worsen November figures and improve the December figures, while the effect will be cancelled out for the three month to December figure.

“Visits to stores in Northern Ireland slipped back in December compared to the same period the year before, rounding off a pretty drab ‘Golden Quarter’ and 2024 as a whole in terms of shopper footfall,” said Mr Johnston.

“Black Friday promotions gave a fillip to foot-traffic early on, however across the month as a whole footfall was feeble and fell across all destinations.”

Mr Johnston said there was little denying these were disappointing figures for retailers with bricks and mortars premises, many of whom would have been hoping for a final flourish to the year.

“That said, there is rarely an exact correlation between footfall performance and retail sales growth, and with a third of non-food retail sales purchased online, it may be that retailers have proved adept at harnessing technology to get through to consumers who may not have the inclination or time to travel to shops,” he added.

“This remains a period of significant flux for retail. Weak footfall, sluggish demand, rising government-mandated cost pressures, and an uncertain outlook are all weighing on stores. The structural, economic and regulatory changes affecting retail show few signs of abating.”

Retail Consultant EMEA for Sensormatic Solutions, Andy Sumpter said the overall picture was filled with much less sparkle as shopper traffic remained subdued.

“While store visits did build ahead of Christmas, it was never quite enough to reverse the shopper count deficit against last year,” he said.

“As footfall limped towards the festive finish line, December’s lacklustre performance compounds a disappointing end to 2024, marking the second consecutive year of declining store traffic.

“Retailers will now need to look afresh to 2025 and chart a course to adopt innovative strategies to reverse this trend or maximise the sales potential of fewer visitors, finding new ways to make each store visit count.”