Grocery price inflation slowdown stumbles, latest Kantar figures show

There was a softer decline in grocery price inflation in January, with a slight fall to 6.8%, down from 6.9% in December 2023, as the proportion of items bought on promotion dropped compared with December.

Items bought on offer accounted for 27% of all grocery spending in January versus 32% last month.

Meanwhile, take-home grocery sales grew in value by 2.9% over the four weeks, according to the latest report from Kantar.

Plant-based and no/low alcohol sales saw a boost, as would be expected in January, but Kantar noted the trend is towards healthy habits all-year round, not just in January.

Spending on alcohol fell by more than half compared with December, as almost 6% of beer packs sold this month were no or low-alcohol options, marking a jump from 4% at the end of last year.

As head of retail and consumer insight at Kantar, Fraser McKevitt explained, health always comes to the fore as a priority for consumers in January.

“What’s interesting this month is that we’re not seeing as big a spike in health-related categories as we have done in previous years. That’s because people are now buying more of the typical January ‘health kick’ items throughout the year,” said Fraser.

OPPORTUNITIES FOR SAVINGS

Fraser added that sights are firmly back on inflation again.

“There’s been lots of speculation about the impact the Red Sea shipping crisis might have on the cost of goods, but the story in the grocery aisles this January is more about the battle between the supermarkets to offer best value, rather than geopolitics.

“Retailers have taken their foot off the promotions gas slightly as we’ve come into the new year, and that’s meant inflation hasn’t fallen as quickly.”

He added that there are still plenty of opportunities for consumers to make savings.

“The overall trend in offers is up versus this time last year, and nearly £500 million more was spent on offers this January than in the same month in 2023,” said Fraser.

“Looking ahead to February, it will be interesting to see how this plays out on Valentine’s Day, and if couples will opt for more low-key celebrations.

“This was certainly the case in 2023, when we saw a massive £43 million spent on supermarket meal deals costing £10 or more in the week before the special day.”

GROWTH FOR LIDL

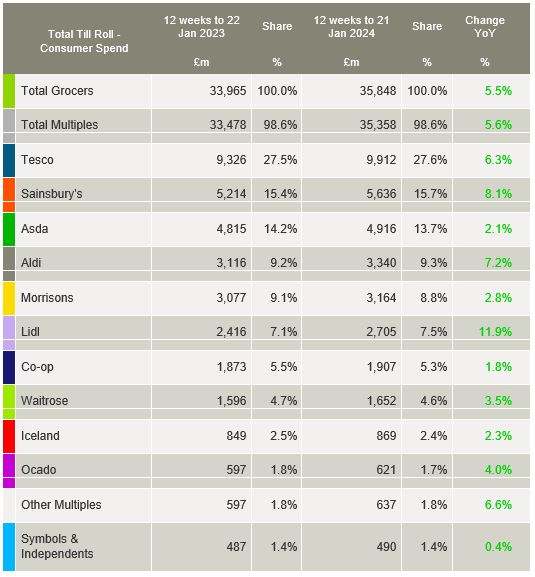

Lidl is the fastest-growing grocer in Britain for a fifth month in a row, and the only retailer to see double-digit growth in the latest 12 weeks.

According to Kantar, spending at the discounter was up by 11.9%, bringing its share of the market to 7.5%.

Both Sainsbury’s and Tesco gained market share over the latest 12 weeks to 21st January 2024 compared with a year ago. Sainsbury’s increased sales by 8.1% to take 15.7% of the market, 0.3 percentage points higher than last year, while the UK’s largest retailer Tesco grew by 6.3% and now has a share of 27.6%, up from 27.5%.

Meanwhile, Co-op accounts for 5.3% of the market, growing sales by 1.8% and Iceland saw growth of 2.3%, giving the frozen food specialist a 2.4% share.